Acquisition project | Groww

Section 1: About the product, growth, competitor landscape

About the product:

Groww started with a vision - "Ab India Karega Invest (AIKI)", that is akin to making investing accessible, affordable, understandable in India. In a nutshell Groww is aiming to simplify finance in India. Through Groww one can invest in Mutual Funds, Stocks, ETFs and trade in F&Os.

Quick Stats:

- Avg Rating app rating 4.1

- Android App downloads: 50mn+

- $3Bn valuation as on Oct 2021

- Active user base as on Feb 2024 - 9.1Mn*

*Active user base as per NSE are users who have made atleast one transaction in that financial year. Hence no of registered users is not considered when evaluation brokers.

Growth:

From a mutual fund distributor in 2017 to becoming the largest broker in India (in terms of active users), groww is poineering towards become a financial services super app.

Competitor Snapshot:

As of Feb 2024:

App | A/C opening charge | AMC | Delivery Charges* | Knowledge Center | Avg App Rating |

Groww | 0 | Free | 20 per executed order or 0.05% whichever is lower | Available | 4.2 |

Zerodha | 200 | 300 | 0 | Varsity | 3.5 |

Upstox | 0 | 150 | 20 per executed order or 2.5% whichever is lower | Uplearn | 4.2 |

Angel One | 0 | 240 | 0 | Available | 4.2 |

source: https://www.chittorgarh.com/comparebroker/upstox-vs-groww/33/173/

Section 2: User Research, Ideal Customer Profile, Market Sizing [source]

User Research:

Recruitement of participants

After doing a lot of secondary research, Groww's maximum user base is from Tier 1 and Tier 2 cities. They started with their journey of Simplifying investment for the Mass Market in India (As per Elevation capital report). I interview random people from all works of life and different income brackets to understand their approach towards personal finance

Macro-level objective:

Understand from individuals who have monthly income or savings in some form, what is their approach towards personal finance and money management. This will help me define my ICP and also build acquisition strategy accordingly

Micro-level objective:

- How do manage their money post monthly expenses

- Where do they seek information related to savings and investments

- What is their primary goal for saving or making an investment

- Users with low income levels are worried about fraud and don't trust cold calling very easily but rely on friends suggestion of their or clients (Cooks, househelp, gym trainers)

- People need more education around investing

- People with affluent and higher income level follow financial influencer to make investment decisions

- HNI Clients rely on Relationship managers to make the decision on their behalf

Key Insights:

- Users rely a lot on word of mouth and recommendations by friends to explore an investment app

- They understand the power of compounding and making monthly investments

- 90% of users have goals of creating a retirement corpus

Ideal Customer Profile

Based on the value propostion that groww has to offer:

Simplifying investments in India for the next Billion also the macro narrative which is changing from -

"Roti, Kapda, Makaan, Data" to "Roti, Kapda, Makaan, Data & Equity"

ICP 1:

- Avg annual income around 2L - 3L

- Aspirational to research on their own on youtube by seeing ads and asking around

- Ready to save 15%-20% every month as part of their earnings

- Attached investment to a future goal

ICP 2:

- Avg annual income above > 30LPA

- Follow financial influencers and research on their own to make an investment decision. Diversified portfolio

- 30-40% of their monthly income

- Attached to a future goal: Start a business, retirement planning

Influencers ✅

- Low cost and low barrier to entry into stock and mutual fund investing

- Power of compounding, make your money grow.

Blockers 🚫

- Don't trust online platform and need human touch for getting started, are worried about scam and fraud

- Too many apps to manage and would stick to the app linked to savings account

- Stock market is gambling and not for everyone

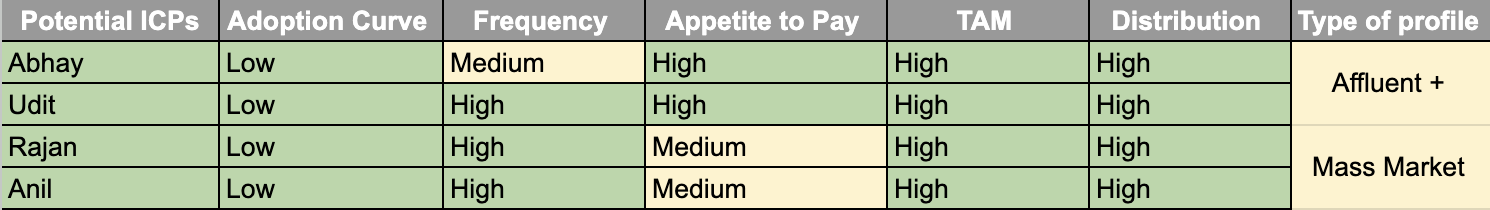

ICPS for Groww:

As per elevation capital report definition of two ICPS are: affluenct class is anywhere the Annual income is 30 - 60LPA and Mass Market avg income is 2-3 LPA which is also India 1 and India 2 definition

Other users:

User Research Raw Data:

Easier to consume here: https://docs.google.com/spreadsheets/d/1P0Tdxlc7hwatdHGIrVpIYZHvUCyFXpU546n1tCw80uY/edit#gid=885246805

| Parameters | Alisha (Friend) | Jitu (Neighbourhood Kirana) | Rajan (Neighbour's cook) | Anil (Personal Trainer) | Harsha (Parlour didi) | Laxman (Fruit vendor) | Abhay (Colleague) | Udit (Colleague) | Krunal (GX19 fellow) | Vanshika (GX19 fellow) | Rishabh (GX19 fellow) | Anirudh (Growth X member) |

| Demographic | Age | 36 | 41 | 22 | 29 | 37 | 42 | 24 | 33 | 25 | 29 | 21 | |

Gender | Female | Male | Male | Male | Female | Male | Male | Male | Male | Female | Male | Male | |

Profession | Visual Artist | Business owner (Kirana Store) | Cook | Gym Trainer | Beauty parlour specialist | Fruit vendor | Senior SW Engineer | Product Manager | Growth Lead | Account Manager | Food start-up founder | Community manager | |

City | Mumbai | Mumbai | Mumbai | Mumbai | Mumbai | Mumbai | Hamirpur | Dehradhun | Mumbai | Bangalore | Bangalore | Bangalore | |

Origin City | Mumbai | Mumbai | Darbanga (Bihar) | Amethi (UP) | Belgaum | Gopalganj | Hamirpur | Dehradhun | Mumbai | Jabalpur | Rajasthan - Alwar | Jaipur | |

Income Level | 40-45 LPA | 7-8 LPA | 2-2.5 LPA | 6 - 7 LPA | 4-5LPA | 5-6LPA | 35-40LPA | 30-35LPA | 12LPA | 15-25LPA | 30-45L | 3-4lpa | |

Category (calculated) | HNI+ | Mass Market | Mass Market - Below Mass | Mass Market | Mass Market | Mass Market | Affluent + | Affluent + | Affluent + | Affluent + | Affluent + | ||

Dependents | None | No | 3 | 4 | 3 | 2 | No | No | No | No | NA | NA | |

Married | Yes | No | No | Yes | Yes | Yes | No | No | No | Yes | NA | No | |

Have kids | 1 | No | No | 2 | Yes | Yes | No | No | No | No | NA | No | |

Earning members in the family | 2 (Husband and Self) | 3 (Brother, Father, Self) | 4 (Brother, Father, Self) | Self | 2 (Self and Husband) | Self | Self | Self | Self | Self | NA | No | |

Languages | English, Hindi | English, Hindi, Gujurat | Hindi, Bihari | Hindi | Hindi, Marathi | Hindi, Bihar | English, Hindi | English, Hindi | English, Hindi | English, Hindi | English, Hindi | English, Hindi | |

| Behaviour and Usage | Device | Iphone 13 | Vivo | Redmi | Oppo Renu | iPhone 15 | Redmi Android | Samsung | Oneplus | iPhone 13 | Android | Android Model - One plus | Android |

Social Media/Content apps used | Twitter, Reddit, Instagram, Pinterest | Instagram, Facebook, Twitter, Youtube , Whatsapp | Facebook, Instagram, Youtube, Whatsapp, Telegram | Youtube, Facebook, Whatsapp | Instagram, Youtube | Youtube, Facebook, | Youtube, Reddit, Instagram, Twitter, Github | Youtube, Instagram, Linkedin, Twitter , Money control | Instagram, Twitter, Reddit, youtube | Pinterest, Youtube, Instagram | Linked, Instagram, Youtube, Spotify, Whatsapp, GMAIL | Linkedin, Instagram, | |

Content consumption | Fitness, Household, Interior, Baby | Videos, reels, ads | Cooking videos, funny videos | Spiritual Content | To see make-up videos, cooking videos | Cricket, Political News, Song videos | Sports, Tech, Business, Start-up, Finance, Sci-Fi | Finance, Stock Market | Documentatores and Dark humour | Penchant for Art and artisticly pleasing content. Financial Data and browse randomly | Podcast related to GrowthX Business and start-ups Philosphical TV series - Dice media , Short web series Paid Subscription - Prime , Spotify , Linkedin Youtube - Free | Finance creators - Sharan, Akshat shirvatsav | |

Do you do online shopping | Yes - Myntra, Amazon | Yes- Amazon | Yes - Meesho, Amazon | Amazon, Flipkart | Flipkart and Amazon | Yes | Yes | Yes | Swiggy, Myntra, Ajio, Mynra | Myntra and Nykaa | Yes and No, Generally use Amazon or Myntra for shopping purposes. For clothing related. UI and UX | NA | |

Where all do you spend money? | Household, Apparals | - | Clothes, Electronics | Household, Baby items,Clothes | Clothes, household itens | Clothes for kids | Gadgets | Sports gear, clothes | Clothes and Beauty | 1. Casual Clothing 2. Perfumes 3. Health and fitness | NA | ||

| Investment & Personal Finance habits | What are some of the common instruments do you invest in eg: Gold, Fixed deposit, RD, Insurance, Real estate ? | Decently diversified - FD, Mutual Funds, Stocks, ETFs | Shares LIC - Insurance | Savings account - Don't know how to manage Trading on a demo account - learning LIC agent came home and they opened an account, 3200 per month Real estate - appreciation 4 - 7 lakh price appreciation in 4 years | Share market - Angel broking app, SIP mutual fund, Mirae asset Sukanya Samriddhi Yojana, Medical Insurance | Fixed Deposit, Insurance, NPS, Mutual Fund (SIP) Through our insurance agent in SBI bank | Bank Savings in SBI bank. No knowledge of other savings option. I send money home for expenses | Stocks, Mutual Funds, Crypto | Stocks, Mutual Funds, F&O, IPOs | Equity, Smart Deposit, ETF | Safe investor, MFs and SIPs, FDs and PPFs | "Started with FD and started less amount.And stopped. Mutual and Stock market - Equity funds. Stock - Big brands How did you move from FD to stock and MF? 1. Friends at office and have this discussion. Where to invest and what all to invest z 2. Direct work was commodity trading Following channel and spaces - Ankur Warikoo and some influencers. More around distributing knowledge " | Paused investing for now |

Long-term goals for investment | Wealth Creation, retirement planning | Future security, generate future wealth for emergency | Wealth creation, buy land | Children's education, Passive income | Savings corpus and open beauty parlour | Savings, buy land and emergency | Retire early want exponential asset growth. To invest in start-ups | Become a research advisor through learn how to grow money | Future education (MBA) and wealth creation | For Starting own business | Objective: secondary source of income | Interesting in Trading for now | |

How often do you check the value of your investment ? | Once a month | Once a week | Daily | Weekly | I don't check - Passive investor | NA | Daily | Daily | Monthly | Monthly | Weekly | NA | |

Type of Investor | Long-term | Long-term | Long-term | Long-term, Trader for fun | Long-term | NA | Long to short | Long and Short-term trader | Medium | Long-term | Long-term | Trader | |

What % of your monthly income do you invest | 40% | 15% | 20% | 15% | 40% | 20% | 40% | 10% in trading and 30% in Investing | 30-50% direct goes into savings and investment. Monthly basis | 30-40-40 rule 30% savings and investments 40% - Need 40 - Desire Leisure and entirement and share remains the same | NA | ||

Which app do you use | HDFC securities | Sharekhan for shares LIC - Through an Agent | Metatrade, angelone | Angel one, Mirae Asset, NJtrade | SBI bank through our agent | SBI bank | Zerodha, Coin, Binance | Zerodha, Money control, Groww for investments, Crypto | Fimoney , Kite | Groww | Paytm - Mutual Funds (Friend recommended) Axis Direct - Stock investing (For compliance reasons) Moved to Axis Direct Ring Not actively investing | Upstox, Groww"Used couple of apps - Zerodha, Groww, Upstox. Looks very plain as compared I prefer groww - UI is very good. Whenever you want to invest in IPO groww was the easiest " | |

Where did u hear? | Husband | Friends and advertising - Instagram, FB | Telegram channel, whatsapp, youtube, Ads | Facebook, I have no knowledge. A client helped me in the gym. I moved to Mirae for trading as Angel broking was very expensive. Use google search also to readh | My husband helped me, he heard from his friend at work. (Her husband is a worker in the production house of Balaji) | Village friends helped | Online I research a lot and discuss with friends and colleagues coz i am in fintech | Self research | Fi - Randomly and try new fintech apps Kite- Friends (Birthday gift) | Friends | Friends and work place | Marketing and PR. Groww is very Viral Content marketing on youtube and instagram | |

What are some of the key criterias you consider before making an investment decisons | Past performance, Sector, Topical News | Company performance , Company website , friends and online Google search is common, Company health - ups and downs | Company market cap, past performance, profitability, Ratios - PE and EPS | I ask the agent uncle to do the needful. He takes money every quarter and invests in our intstruments | Money should be safe and secure. I don't trust stock market | Topical news, past formance, stable returns, large cap | Charts and screening tools on Tickertape and Zerodha | Company financials and qtrly filings "IndexFund - tracks all the indexes , no time to research Goldbees and liquid - Diversification Stock research - Read qtrly reports. Whitepaper and ask Chatgpt Tickertape - Screener. Integration with Zerodha - overall sentiment " | "Tickertape for investing to analyse fundamental. Brand and also studying the market. Per share pprice. Blogs - Finshots, sharan hegde " | ||||

How often do you discuss about your purchases or investments with your friends and family? | Once a while when i have some decent returns and dividends | Don't recall | Yes on whatsapp | Frequently | Never | NA | Frequently | Frequently. I have a whatsapp channel | |||||

Where do you consume information related to investments | Money Control, HDFC reports, Youtube, Relationshp Advisor on Whatsapp | Google search, Sharekhan website, company website | Telegram channel, whatsapp, youtube, Ads | Youtube videos, google search | I don't | NA | Youtube Influencers, company reports, Money control | Company research | Self research | Basics - ICICI bank mobile Invest and understand - Groww Understand the market and where to invest - Fluencer and youtube Specific Fluencer - Rachana Ranade and Ankur Varikoo | Twitter, youtube, blog | Finance Sharan, Creators - Akshat shrivatsav for finance | |

How likely are you to recommend Investing and personal finance management to your friend? | Very Likely. It has ensured i follow discplined investing and I feel empowered | Very Likely | Very Likely | Yes i share and i get rewards I will be happy | Yes I will. As i feel good that my money is helping our future goals and I am saving | NA | Very highly as I have generated positive returns | Very likely. | Likely | Strongly | Beginner and not a trader. Il recommend groww | ||

What are some of the biggest Hurdles in Imvesting | Goal based investing and next opportunity to invest. A single platform for everything | Nothing | Knowledge, Scared of fraud, someone needs to explain how to do and charges | Lack of Knowledge, Gamble market, Money can do down, Fraud and scam | Lack of knowledge | Fraud and losses | Consolidated view | None | 1. Crypto is discouraged 2. No issues Information aggregation | "Knowledge available is very scattered, some sort of streamlined data and information Groww was pushed by colleagues, i use to put keywords on google. And google use to bombard you and that is when influencer Educational platform and h olistic and streamlined " | "1. Problem logging in UX , took 7 days on Paytm 2. Disconnectivity in financial services. Customer support. Resolve " | ||

Frequency of investment | Once a month for Mutual Fund SIP and Stocks based on news and need basis | Depend on market 1-2/month Cash flow is not steady and hence can't decide. | Monthly | Monthly | Never | NA | Need basis to Monthly | Fortnightly | Monthly | Monthly | |||

What is your first impression about Groww? | Easy to use and clean, Clutter free | Never heard about Groww | Seen videos | Don't recall | Don't know | NA | Easy to use and decluttered | UI/UX | 2019 - apps that promote a lot get a negative impression and trying to hard to get customers. Like Groww and Upstox | User Friendly | NA | Used couple of apps - Zerodha, Groww, Upstox. Looks very plain as compared I prefer groww - UI is very good. Whenever you want to invest in IPO groww was the easiest | |

Where did you hear about Groww? | Friends told me its low-cost | NA | Facebook Ads | Friend recommened | - | NA | At work | Organic Research | Friends at work | Friends and marketing ads | Marketing and PR. Groww is very Viral Content marketing on youtube and instagram |

Market Sizing:

“There were close to 200 million people with investable income in India, while only 20 million actively invested and the way to bring the next 180 million on board was by making investing simple” - Groww’s founder, Lalit Keshre

At a broad-level this was the market sizing down by the founder of the app when starting the journey.

Addressable Revenue:

- Groww avg revenue per transaction for stocks - Rs. 20

- On an average the order value given for Mass Market would be around ~ 10k/month * 12 which makes it to be around 1,20,000 per annum

- On an average the order value for Affluent Market per annum would be 30% of their salary (35LPA) which amounts 10,00,000 per annum in volume

TAM for overall market for Groww is = 450 mn

Taking avg of order value for both ICPs = 0.5 mn

Servicable Addressable Revenue

Users who have savings account have ability to invest in stocks as they have liquid cash

~77% of the total TAM

Servicable Obtainable Revenue

Market share of Groww is 11% as compared to other brokers in terms of revenue

Section 3: Channel Prioritisation, New opportunities

Channel Prioristisation

Based on the User Research and Secondary Research, the below channels have qualified to put in effort for maximising growth fo Groww app.

Priority 1 - Referral Marketing

Groww has seen a strong Word of mouth publicitiy in its initial PMF days and early scaling days. The network effort framework worked well for groww in Tier 2 and Tier 3 cities. Few things that worked from 1 - many scale point of view:

- Whatsapp communities

- Micro communities in Tier 2 and Tier 3

From user research we have the following insights that

Framework | | | |

|---|---|---|---|

Who & When should you ask | Aha moment - Booked profits, Received dividends, | Second order effect - Placed order successfully, Tracking investments | User has rated the app as 4 and above |

How will they refer | Home screen discovery , post aha moments | Accounts menu | |

Why wil they refer? | Incentive to invest on the platform | |

Brag worthy moment: (How, where, who)

Since investment apps have delayed gratification we can nudge users for referally during the below points in their journey:

- Booked profit of an investment done through Groww: The first principle of investment app is to generate positive returns in the long-term for a investor

- Account opening flow done seamlessly : Given the traditional app tedious KYC process, groww has simplified account opening by using e-kyc and other agencies

- Applied for IPO and shares alloted:

- Second order effect: Add a nudge on the home screen if the user has

- Rated above 4 on the app or play store

- Given a promotor rating of NPS on the app

- Left a positive review or given a high CSAT score on chat

Happy flows: As shown below are the brag-worthy and aha moments for a product like Groww

Platform Currency (What and why)

Referrer:

- Investment product or funds to invest in an instrument

- Waiving of transaction charges will not excite the customers as the amount is very less compared to the amount they are investing

- Credits in the account which can be redeemed to make transactions in Mutual Fund SIPs

Referee

- Waived of charges for their first transaction

- Credits in the account to get started instantaneously in Mutual Fund SIPs

Why mutual fund SIP as incentive?

There is business vaibility in this as we are nudging users to take the first step towards Mutual Fund SIP and subsequent SIPs they can place order and Groww platform can earn commission. Mutual Fund is beneficial in the long-term if invested regularly via SIPs (Power of Compounding)

How will they discover on the platform?

As show in the brag moment, we will add banners and nudges in the above points which qualify as Aha moments for the user while they are using the app.

How will they share the referral Link?

- Share direct message on Whatsapp (1 to few)

- Copy link and post on Social media (1 to many)

Referral Flow:

- User 1 refers a friend to join Groww app (User 2)

- User 2 installs the app

- User 1 will only get the credits in their account once User 2 has activated their account i.e. made a successful transaction

- Once U2 has transacted and has a holiday period of 3 months in the invested Mutual Fund, if U2 exits before that U1 won't be eligible for the offer

- U1 will get the reward once U2 has invested

Priority 2 - Paid Ads

Selecting the Mass market category of customers who have the aspiration and enthusiasm to learn and start their investment journey and also maintain a regular cadence with their investment. Hence stickness of such users will be high if we are successfully able to onboard them

As most of these users spend most their time on Facebook and Youtube consuming content. We can target them on these platforms and show relevant adds with the following creative pitch

ICP 2 - Mass Market, Low income group and active on Facebook and Youtube.

| | |

|---|---|---|

Channel Selection | Youtube Ads, and Facbook Ads | |

Audience Segment | Tier 2 and Tier 3 city evening users living in Tier 1 city are respresentive of 2 and 3 segment | |

Campaign Structure | Objective: App install to Sign-up Ad Groups: Android, 21-41 Ad Creative : Channel Specific |

Pitch:

- Low cost, easy to investing and simple to getting started

Reference: https://www.youtube.com/watch?v=jJSIj0HxcE8

Pitch:

- Highlights how you can invest in a diversified portfolio by taking a position in the index fund and capitalise on all sector growth

- Reference : https://www.youtube.com/watch?v=jopopLFTdwU

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.